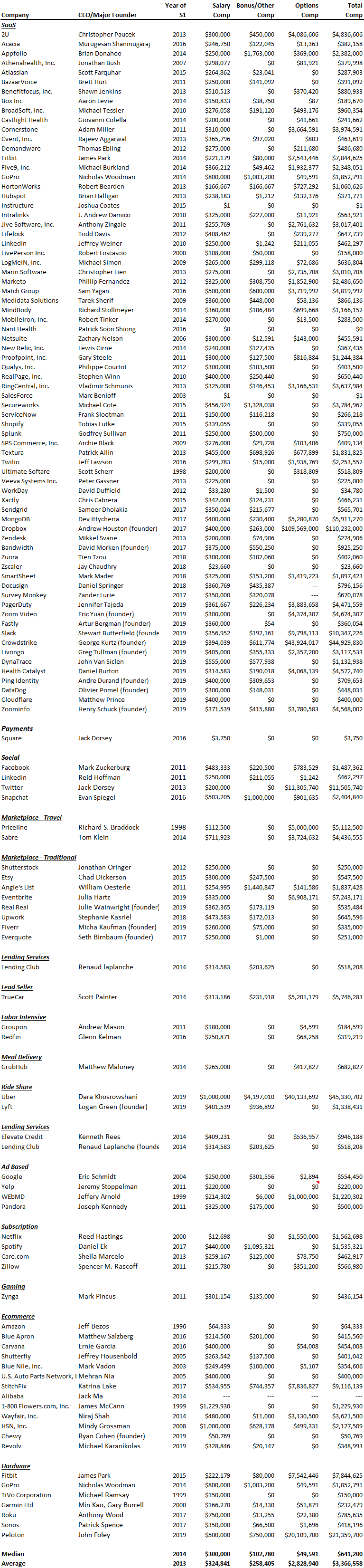

CEO salaries at 125 tech co’s

We’ve seen a wide range of CEO salaries in our portfolio, from as low as $35k annually to as much as $325k (plus bonus). While there is no dataset explicitly outlining salary levels at early stage companies, we can use the salaries from tech companies at their IPO to get a sense for what the salary should be for a successfully exiting CEO. The data below shows the salaries of 125 tech company CEO’s at IPO.

A few observations stand out:

Some of the best CEO’s take the lowest salaries. For instance, Marc Benioff of Salesforce took a salary of $1 at IPO, Patrick Shiong of Nant Health took no salary, Jack Dorsey at Square took only $3,750, and Jeff Bezos at Amazon took only $64,333. That said, these individuals were independently wealthy before the IPO, but it’s always refreshing to see a CEO pass up a big salary if he/she doesn’t need one. It sets an example for the rest of the company, establishes a culture of cash efficiency/frugality, and shows a founder putting the company ahead of himself/herself. Founders taking low salaries also show very well when going to raise money. VC would much rather back a scrappy, frugal founder than one that spends gratuitously and the CEO salary tells you a lot about the CEO’s mantra.

$300k is the median for a very successful company. Keep in mind, the median salary of $300k is for the CEO of a company about to go public. In other words, these companies were all tremendously successful up to the point of going public, yet the CEO’s salary was still lower than that we’ve seen for some venture backed large startups, especially on the West Coast. Be sure to temper your salary accordingly based on the stage of your company.

Other forms of comp include options and bonuses. Note the median bonus was $102k and median option grant had a value of $50k. Indeed, it’s not unreasonable to take a performance bonus annually and it’s also expected that a founder will be granted stock as the Company matures and becomes more successful, especially if their salary is low. Equity, not salary, should be your main focus.

Before the IPO, some of the founders took options worth fantastic sums. For instance, James Park of Fitbit ($7.5mm), Dick Costolo of Twitter ($11.3mm), Scott Painter at True Car ($5.2mm), and Drew Houston at Dropbox ($109mm, not a typo), among others all took home nice option packages the year before IPO. As a CEO, so long as you’re driving fantastic growth and value, it’s not out of line to expect additional option grants as a CEO. It’s actually market, and good investors have no problem rewarding CEOs that are performing.

Salaries have gone up over time. The median level of CEO ownership has risen since 1998. From 1996 to 2007, the median during that period was $214k. From 2008 to 2019, the median was $300k. It’s a good time to be the boss.

We hope the data above is helpful in setting salary expectations. Keep it as low as possible, expect option grants and bonuses for success, and keep in mind the real source of value is your equity: Benioff, Shiong, Dorsey, and Bezos owned 32%, 57%, 24%, and 48% of their respective companies at the time they went public. It goes without saying they made a lot more money on their equity than they did on salaries.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.