Exits take 7 to 9 years

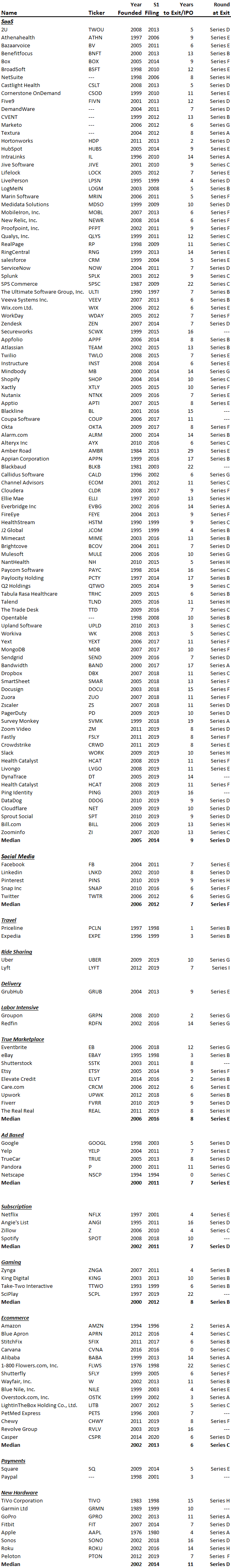

We looked at how long it took 161 publicly traded tech companies to exit. Specifically, we used their S1’s — a securities filing a company makes before IPO — to find out the year each company was founded and compared it to the last year financials were released as a private company. The data is below.

Time depends on industry. The amount of time it takes to exit seems to be partly dictated by industry. For instance, the median time to exit for payment companies (Square and Paypal) is only 4 years whereas hardware companies took on median 11 years to exit. Hardware companies Sonos and Roku took 16 years and 14 years respectively (although note Peloton only took 7). Indeed hardware tends to have a much longer R&D cycle.

SaaS takes a long time. SaaS companies took 9 years to IPO/exit since founding, on median taking funding through the Series D. This makes sense given that sales cycles for enterprise SaaS companies tends to be so long.

B2C focused companies exit faster. Social Media, Marketplaces, Ad Based businesses, and other “soft” tech products focused on the consumer exited faster than hardware and software. Ecommerce took 6 years and payments took 4 years. Excluding hardware which has a heavy R&D component, B2C companies tend to scale faster due to virility and the tendency for hot B2C companies to attract tremendous media attention.

The 90’s were awesome. Netscape IPO’d in 1994, the same year it was founded. Netflix IPO’d 4 years after its 1997 founding. Google took 5 years after being founded in 1998, TakeTwo took 6 years (founded in 1993), Amazon took 2 years, and Overstock took 3 years. Companies with a pre-2000 founding vintage got to exit very fast even though they were far smaller than their predecessors that IPO today. The 90’s were an incredible time and you could exit with ease relatively quickly whereas today, investors require a lot more revenue which takes time to build.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.