Tech company multiples Q2

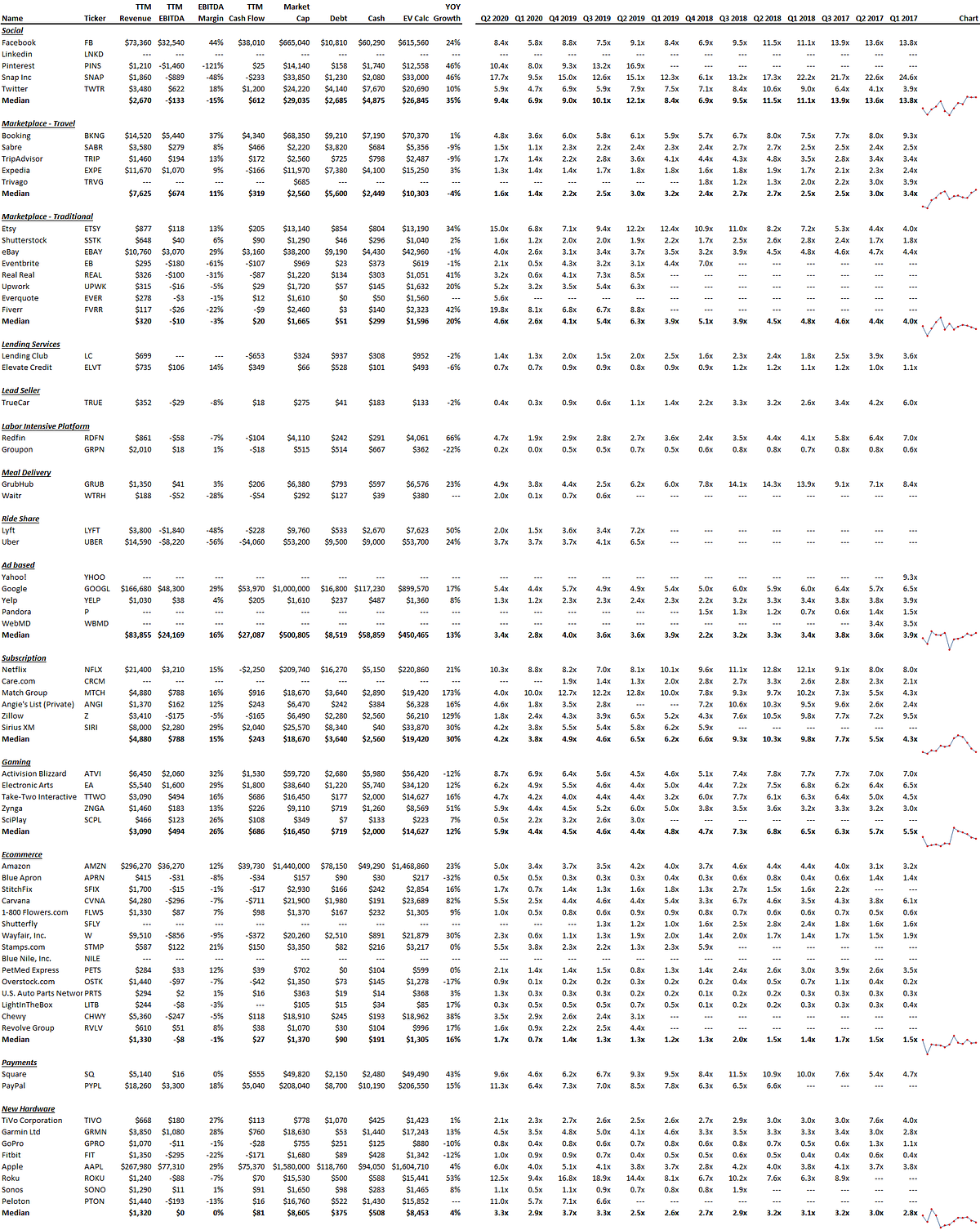

Below are revenue multiples for publicly traded consumer tech companies we follow (B2C). The data is as of June 30th. Industries and therefore multiples vary widely. Commentary is below.

Social media is back at 9.4x. The highs in 2017 were ~14x, but a more normalized multiple historically has been around ~9x. Snapchat is at 17.7x after falling from 40x in Q4 2016, and still lost nearly $1bln in EBITDA on $1.8bln of revenue. Pinterest lost more in EBITDA (-$1.4bln) than it generated in revenue ($1.2bln) but still trades at 10.4x. Alternatively, the most acquirable of the group, Twitter, trades at 5.9x but had +$622mm of EBITDA and respectable 10% YOY revenue growth.

Traditional marketplace multiples vary widely. Prior to Q3 2018, the sector only had 2 companies and now has 8. The median multiple is now 4.6x, but Etsy is at 15.0x while Fiverr is at 19.8x. Etsy grows at 34% YOY with $877mm of revenue, and a solid 13% EBITDA margin. Ebay is trading at a historically strong 4.0x revenue multiple and even though growth is -1%, they generate significant cash with a 29% EBITDA margin.

Discounts and couponing are dead. Remember when Groupon was a high flier? Well today it has stopped growing (-22% YOY growth) and pretty much trades at the value of cash it has on the balance sheet. This was one of the fastest growing companies ever that came up during the recession of ’08, and now no one cares. There is a chance it comes back in this environment, but generally your business should not revolve around discounting and couponing.

Grubhub. Grubhub popped to 4.4x revenue in Q4 2019, but that’s because they recently announced they’re for sale. Meal delivery has become increasingly competitive as peers like Uber and DoorDash continue to overspend on customer acquisition as if the market can only support one winner. Uber did just buy Postmates July 6th for $2.65bln in stock.

Rideshare is bifurcating. Lyft is at 2.0x revenue while Uber somehow is holding strong at 3.7x revenue. We suspect the revenue multiple for both would be higher, but both businesses light cash on fire; Uber’s EBITDA is -$8bln while Lyft is at -$1.8bln.

Subscription. Subscription has been humbled since 2018, and now trades at 4.2x revenue. Netflix revenue multiple continues to be the outperformer at 10.3x. Care.com no longer trades as it got acquired by IAC in December 2019 for $500mm (2.5x revenue). Match fell to 4.0 revenue from 10.0x while Angie’s List rose to 4.6x.

Gaming. The median revenue multiple of 5.9x is strong. SciPlay, the latest IPO in the space, is an underperformer at 0.5x.

Ecommerce is back. The sector is the least attractive to investors, with a median revenue multiple of 1.7x. There is a big difference between what we would call premium ecommerce like Stamps.com, Carvana, and Amazon (5.5x, 5.5x, and 5.0x), versus weak ecommerce like Blue Apron (0.5x revenue). The latter are far less discretionary than the former. Chewy which is a new, massive non-discretionary ecomm player ($5.3bln in revenue) trades at 3.5x, likely because it still loses money (-$247mm). We would note it has excellent customer retention metrics though and will likely be a premium ecomm player for years to come, if not a nice acquisition target.

Hardware is consistent. Hardware is steady at 3.3x, and has traded in a tight range historically of 2.0x to 3.8x. Roku is the standout of the group (12.5x) as it’s growing at a strong 53% YOY. Peloton, the latest entrant, trades at 11.0x on $1.4bln of revenue, but they lose money, even though prior to the IPO they said they were “profitable”.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . Find Sammy Abdullah on LI. We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.