The ok level of SaaS burn

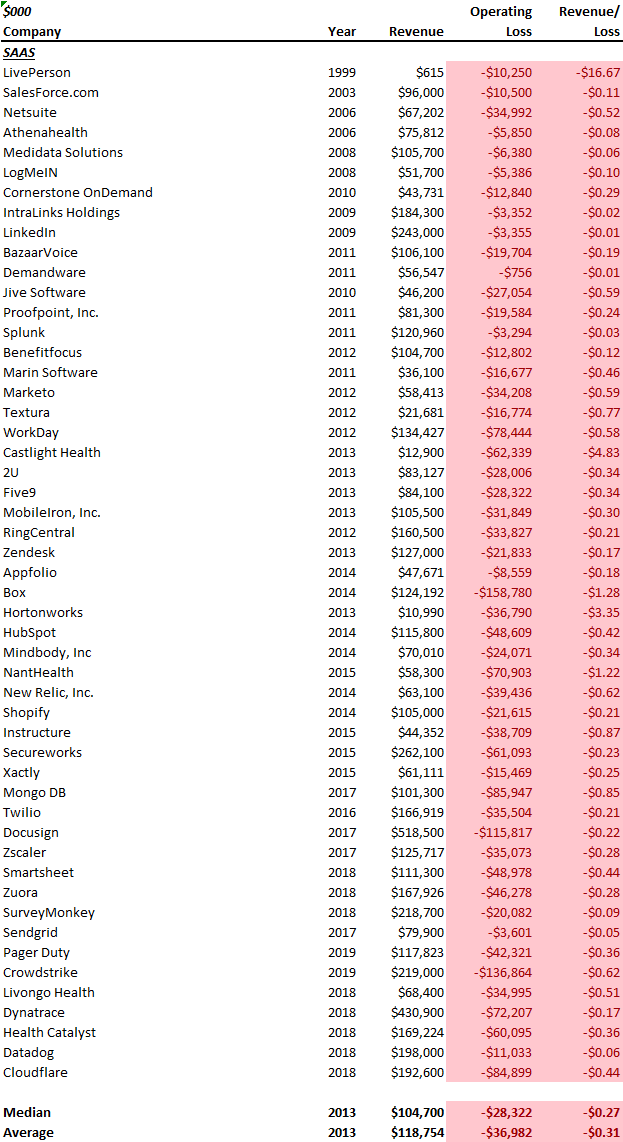

Of the 62 SaaS businesses that have gone public which we follow, 51 of them were not profitable at the time they went public; that’s 82%. Clearly a certain level of burn is ok so long as you’re growing, but what is that level? Can you lose $1 for every $1 of revenue? Can you lose $2? Can you lose more? The answer to that question is below.

Of the 51 unprofitable SaaS companies that have gone public, on median they burned only -$0.27 for every $1 of revenue and on average the loss was -$0.31 for every $1 of revenue. For the 11 SaaS business that have IPO’d since January 2018, the average burn was also -$0.31 for every $1 of revenue.

In summary, so long as you’re growing fast and there is a clear path to profitability, burning about $0.30 for every $1 of revenue is acceptable. Otherwise, you’re WeWork.

Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at . We invest $1mm to $1.5mm in growth rounds, inside rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.